THE MARKETING ENVIRONMENT

The notion that every living organism lives in a habitat or an environment is borrowed from biology. Biologists maintain that the living organism, whether it is plant or animal, has tomonitor and adapt to its habitat or it would face extinction. Similarly, geographers realize that a man either conditions his physical environment or conditions himself or, more likely conditions both in order to maintain some equilibrium with his physical environment. In sociology, man is conceived of as a social animal that is subject to environmental influences. It is not strange, therefore, that marketing is also conceived of as being practiced in an environment that is in a constant state of flux. This environment consists of “the totality of forces and entities that surround and potentially affect the marketing of a particular product.” Its components can be divided into two major categories: the internal marketing environment and the external marketing environment.

1. The Internal Marketing Environment

This is made up of those variables or forces that are internal to the company but which are outside the direct control of the marketing manager. Notable among these factors are the goals, orientations, plans and actions of the production, personnel, finance, accounting and research and development departments. The actions of these departments have vital implications for the marketing department. For example, unless the finance department is able to raise needed funds, unless the personnel department can recruit well-trained and experienced marketing personnel, and unless the production department can produce enough to meet demand and consumers’ quality standards, the ability of the marketing department to perform might be seriously jeopardized. Up till 1982, it was practically impossible for many breweries in Nigeria to meet the demand of distributors and consumers because of their limited production capacities. Budget constraints imposed by top management sometimes make it impossible for many marketing managers to pursue otherwise viable marketing programmes. There is no doubt, therefore, that what goeson in other departments of the enterprise can substantially affect the marketing department and its programmes.

2. The External Marketing Environment

This is made up of variables outside the firm as a whole, and is generally regarded as being outside the control of the marketing manager. Because of this, factors in this aspect of the environment are sometimes called uncontrollable variables, although many firms, acting jointly, may in the long run be able to exert some influence on them.

This environment consists of economic, technological, socio-cultural, legal and political forces. Examples of some economic forces in Nigeria that are of relevance to marketing, are the austerity measures enshrined in the Economic Stabilization Act, 1982, inflation, scarcity of essential commodities, smuggling and high rate of unemployment. Nigeria has experienced sociocultural changes since independence, Notable among them are rapid urbanization, increased education and public awareness, increased resort to the legal process as a means of securing redress, increased materialism, an upswing in the wave of crime and moral depravity, and more corrupt tendencies particularly among public functionaries. The Nigerian marketing environment has since 1960 also witnessed a wave of new laws regulating businesses as well as political changes.

In the legal arena, there have been laws regulating trade unionism, trade disputes, prices, ownership/participation in business by foreigners, product standards, and the establishment and operation of insurance companies. These and other business laws circumscribe marketing. Political developments in Nigeria in the last two decades include the change from parliamentary democracy to military dictatorship and then to the presidential system. Others are governmentownership of most schools and newspapers and the creation of more states.

As mentioned earlier, the external environment, in its dynamism, generates changes some of which are inimical to the marketing of certain products and others which enhance the marketing manager’s chances of success. These changes are respectively referred to as threats and opportunities. No wonder, therefore, that although this environment is generally regarded as uncontrollable, it should be constantly monitored so that these threats and opportunities can, where possible, be used to the marketing advantage of the company. The marketing manager should constantly monitor and assess the impact of these environmental factors so as to formulate appropriate responses.

CRITICISMS OF MARKETING

In spite of its inevitable role in any society, there has been widespread criticism of marketing, not only in Nigeria, but all over the world. An analysis of such criticism shows that the cfitic’ are displeased with some of the techniques that marketers employ as well as the alleged overall impact of various marketing activities. Furthermore, some of the arguments are economic while others are social and, therefore, sometimes emotional. The major criticisms are examined below.

1. High Prices

Marketers have been accused of being largely responsible for the high prices of many commodities especially food items. This is particularly true in Nigeria where a car imported at an aggregate cost of N25,000 can be sold for N42,000. Market women form cartels which, in addition to restricting competition by limiting entry, also fix prices for members. Competitors attempting to enter the trade without complying with the stringent requirements of the cartels have sometimes been physically manhandled.It is no wonder, therefore, that food items sell at exorbitant prices.

The issue of high prices is not only applicable to middlemen. Manufacturers have been known to increase their pric.es, sometimes arbitrarily, at the slightest excuse. Vehicle assembly plants hike their prices by up to 25% and in quick successions. For example, between 1981 and 1982 the prices of one make of cars were raised at least three times.

Arbitrary increases in prices were most rampant in 1982 after the introduction of severe austerity measures. The price of the giant size of some detergents rose from W2.50 in 1981 to W4.00 in 1983 in many parts of the country. Taxi fares rose by 50% while bus fares were raised by 100% ostensibly in response to a 33% rise in the price of petrol.

The excessively high increase in prices is not new. Immediately after the civil war (1967-1970), the problem was so acute that the government introduced price controls for essential items such as salt, milk, flour, sugar and petroleum products. The price control was largely ineffective. With the repeal of the Price Control Decree (1970), prices are now monitored by the Productivity, Prices and Incomes Board which, as the name implies, advises the government on matters relating to prices, incomes and productivity.

2. Hoarding

Nigerian middlemen have been castigated for creating artificial scarcity through hoarding. In simple terms, hoarding is the process whereby a seller of a commodity stores and refuses to sell it now, for no reason other than to cause artificial scarcity and thus force up price, or thereby secure some other undue advantage at the expense of consumers. Hoarding is more effective and more profitable when the commodity in question is scarce. This was a common phenomenon in the 1970s in Nigeria. So serious was the problem that the FederalGovernment in its Price Control Decree (1977), made hoarding an offence punishable under the law. Even as recent as 1982, it was common to find vehicle dealers, beer and cement distributors hoarding their wares.

Hoarding is generally considered undesirable because it creates artificial scarcity, long queues of customers wishing to buy the product, and other unwholesome trade practices. Most importantly, it tends to push up prices unduly.

4. Unsafe And Shoddy Products

The unanimity with which the quality of most made-in-Nigeria goods has been condemned is alarming. In a study of consumer perception of locally manufactured textiles, Oyegunle found that 93% of the 171 consumers interviewed in Kano metropolis believed that locally made textiles were inferior to imported ones. In spite of this perceived inferiority, 54.4% of the respondents felt that local textile materials were more expensive than their imported counterparts.

Expired drugs, and unsafe products are freely sold while “seconds” and “rejects” are sold as new. Match sticks hardly ignite, new cars malfunction and zippers do not fasten. These observations have led to the conclusions that Nigerian manufacturers have earned themselves a bad reputation and that Nigeria is a country where consumer satisfaction does not appear to matter.

It is, however, surprising that these malpractices continue unabated in spite of the establishment of the Nigerian standards organization in 1971 and the Food and Drugs Administration in 1974. Both of these organizations were established to ensure that products and foods and drugs met certain quality and safety standards. The problems of acceptability of local products were extensively discussed in chapter 25.

5. Excessive Materialism

Through promotional activities, marketing isbelieved to make people more materialistic. For example, many Nigerians are known to have limitless acquisitive tendencies; they go for big and flashy cars, expensive clothings, the latest in stereo equipment and the most expensive Italian shoes. They travel to London, New York, Hamburg, Paris and Rome to shop. Some very rich ones even have private jets. Some others own more than five private cars, some of which are often idle.

6. Deceptive Practices

The notion that Nigerian marketers indulge in deceptive and unwholesome practices, particularly in their promotional activities, is illustrated by the following observation:

We think that puffery is too mild a word to describe the expectations that Nigerian advertisers try to promise consumers for products. [X] soap is advertised to portray instant acceptability, instant preference and automatic superior appeal. Pain relieving tablets are advertised as cures for the pains. e.g. [P] for curing headache. [Z] motorcycle is not only advertised for its unparalleled speed, it is supposed to win the rider instant acceptance by the opposite sex. [Y] beer is said to bring happiness literally, building material companies advertise products they actually do not have.

Probably because of the relative ignorance of many consumers and lack of appropriate government action, many advertisements in this country make unsubstantiated claims about their products. Not only are some advertisements alleged to be deceptive, but many are, in fact, misleading.

7. Morality

Some critics of marketing condemn the free display of nude and half-nude women on television, magazines, and newspapers. They argue that such advertisements have a corruptinginfluence on viewers and readers, particularly teenage children.

In addition to advertisements, another way in which marketing is said to contribute to immorality in our midst is through the sale of “unmentionables” such as contraceptives, pornographic films and video cassettes, and pornographic magazines and calendars.

8. Pollution

Critics of marketing claim that it is a pollutant. It pollutes our environment through the multiplicity of posters, billboards and notice boards it uses. The omnipresence of advertisements on television, radio, and newspapers is considered a nuisance. Billboards disfigure the beauty of our physical environment; advertisements disrupt interesting programmes and fill up about 75% of some newspapers and magazines. Marketing is also accused of polluting our culture by encouraging foreign consumption patterns and life-styles.

9. Manipulation

Critics denounce marketing for its alleged manipulative tendencies. This denunciation is based on the notion that marketing uses unfair methods such as hard-selling to get people to buy what they do not really want.

COUNTER-CLAIMS

Defenders of marketing are not impressed with the above alleged misdoings of marketing. They argue that most of the allegations are based on a misunderstanding of the role of marketing. For example, they claim that marketing does not cost too much. The rise in the prices of goods as a result of the activities of middlemen is seen as the price which consumers have to pay for the indispensable services which middlemen render. The fact that consumers are willing to pay the prices charged by middlemen is said to be indicative of theconsumers’ recognition of the contributions of middlemen.

Some marketers are of the view that most of the arguments against marketing are actually not against marketing but against the business enterprise as a whole.

Defenders of marketing argue that the manipulative power of marketing is exaggerated. Some, in fact, argue that marketing does not even attempt to manipulate; it simply identifies existing consumer needs and tries to fulfill them. They, therefore, depose that it is the consumer who is inherently materialistic; it is he who pollutes our culture and our environment. They consider it ironical that promotional activities, without which consumers cannot make informed decisions, are regarded as a nuisance.

Finally they assert that even if marketing were an evil, it is a necessary one whose services consumers welcome and are ready to pay for. It is further argued that, even if a few marketers were guilty of some of the wrongdoings they are accused of, that is not a good reason to castigate marketing; after all, other professionals are not without blemish.

Questions and Discussions

1. Marketers are also producers. Discuss.

2. Marketing plays a very important role in the production process. Discuss.

3. What environmental factors play important roles in Marketing?

4. Recently, marketing has come under heavy criticism because of some sharp practices. Discuss.

5. Marketing starts ever before the product is produced. How?

References

1. The Committee on Definitions of The American Marketing Association. Marketing Definitions: A glossary of Marketing Terms. Chicago: A.M.A., 1960, p. 15.

2. William M. Pride and O.c. Ferrell. Marketing: Basic Concepts and Decisions, 2nd ed. Boston: Houghton Mifflin Company, 1980, p. 7.

3. Philip Kotler. Marketing Management: Analysis, Planning and Control, 2nd ed. Englewood Cliffs, New Jersey: Prentice-Hall, 1972, p. 13.

4. Ibid, p. 868-882.

5. I.C. lmoisili. “Management Practices and Organizational Effectiveness: A Guide To Conceptual Emphasis in Developing Nigerian Managers”. Unpublished Doctoral Thesis, Columbia University, July 1977, pp. 43-46 as cited in S.A. Olusoga, “The Marketing Concept in A Developing Economy – A Critical Appraisal”. Nigerian Journal of Business Management, Vol. 2, NO.2, July/August 1978, p. 295-303.

6. S.G. Odia. “Marketing: The Neglected Managerial Function of A Booming Economy,” in Julius O. Onah (ed.), Marketing in Nigeria, Experience in A Developing Economy. London: Cassel, 1979, pp.3-6.

7. S.A. Olusoga, ibid. (see reference 6).

8. Philip Kotler. Marketing Management: Analysis, Planning Control, 2nd ed. Englewood Cliffs, New Jersey: Prentice-Hall, 1972, p. 26-27.

9. S.A. Olusoga, op. cit.

10. B.A. Agbonifoh. “Operationalizing the Societal Marketing Concept in Developing Economies: A Rationale and A Guide”. A MAN, Journal of Society, Culture and Environment. Forthcoming Issue.

11. Philip Kotler, op. cit.

12. For a detailed discussion of the economics of hoarding P.N.O. Ejiofor, “The Business of Hoarding” in Julius O. Onah, op. cit., pp. 34–44.

13. George GbolahanOyegunle. “Consumers’ Perception And Usage of Nigerian And Foreign made Textile Materials.” MBA Thesis, University of Benin, 1982, pp. 31-33.

14. D.H. Afejuku. “A Comparative Study of Consumer Protection Laws and Practices in Britain and Nigeria”. An unpublished Research proposal, 1982.

15. Nonyelu, G. Nwokoye. Modern Marketing For Nigeria. London: The Macmillan Press Ltd., 1981, p. 250.

16. S.A. 01usoga, op. cit.

17. BayoAkerele. “The Relevance of Consumerism for a Developing Economy”. Nigerian Journal of Marketing, Vol. 2, Dec. 1980.

BUSINESS CAPITAL: TYPES, SOURCES, MARKET

Money bewitches people. They fret for it and sweat for it. They devise most ingenious ways to get it, and most ingenious ways to get rid of it. Money is the only commodity that is, good for nothing but to be gotten rid of. It will not feed you, clothe you or amuse you unless you spend it or invest it. It imparts value only in parting. People will do almost anything for money, and money will do almost anything for people. Money is a captivating, circulating, masquerading puzzle. – C.N. Parkinson1

Finance is defined generally as the art, science or system of dealing in, supplying, regulating or managing the money and credit of a nation, state or private enterprise. In business, finance involves four important activities.

1. Determining a firm’s financial structure. This calls for a determination of the financial needs, selecting types of financing e.g. equity or debt, and setting up a criteria for selecting alternative financial sources.

2. Identifying alternative sources of financing – equity, long term, intermediate term or short-term debt.

3. Obtaining the needed funds. This calls for selecting alternative sources of funds and securing of the funds.

4. Using the funds effectively. This is done through efficient working capital management and capital budgeting.

Finance plays a central role in the management of any business. Almost every business action has a financial effect on the firm. A manager’s ability to obtain and use funds effectively is a key to the success or failure of his company. As Irwin Friend put it: “A firm’s success or even its survival, its ability and willingness to maintain production and to invest in fixed or working capital, are to a very considerable extent determined by its financial policies both past and present.”

This chapter deals with some aspects of financial management. The subjects covered include Types and Sources of finance, over and under-capitalisation. Financial Institutions, Money and Capital Markets, and Financial Intermediation.

The method of approach is from the Financial Manager’s position. The assumption is that financial management is the primary duty of the Financial Manager. He initiates and implements his firm’s financial policies.

Whereas financial institutions are environmentally oriented, financial principles are universal in scope. Their application to a given economic system depends on the ideological base of the system. Here, we are concerned with the application of financial principles in a mixed economic system which is a modified form of capitalism – that is, the Nigerian system.

Hence, most of the examples will be drawn from the Nigerian financial experience. The basic financial principles will be discussed on the basis of latest prevailing knowledge in the field.

The topics will be discussed in the order in which they were listed above.

TYPES AND SOURCES OF BUSINESS FINANCE

1. Types of Financing

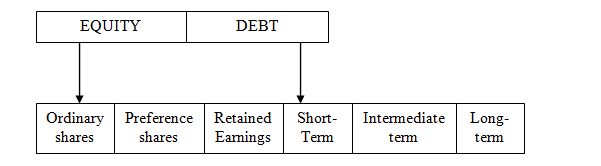

A firm can obtain funds to finance its business either through equity or through debt. Equity – includes ownership interests in sole proprietorships and partnerships, proceeds from the sale of corporate shares and past retained earnings. In a growing business, the owners’equity is the difference between total assets of the business and the total liabilities, that is, the net worth of the business. The evidence of equity interest in a corporation or limited liability Public Company consists of stock/share certificates that among other details show the name of the owner, number of shares and type of stock.

Debt includes any legally binding obligation of a firm to pay a fixed amount of principal or interest for a specified period. Debts could be for a short-term (less than 1 year) intermediate term (under ten years) or long term (10 years and over).

Fig. 38-1 shows the various types of financing as discussed above.

2. Criteria for Selecting Sources of Funds

Potential sources of funds are usually evaluated in terms of specific criteria important to the success of the business. The criteria include:

(i) The costs of obtaining funds

(ii) The timing of principal and interest payments

(iii) The future restrictions involved, especially the possibility that obtaining funds from one source may restrict future borrowing.

(iv) Any effect on control of the business implicit in terms demanded by potential financial sources. For example, a company that obtains new funds by selling a large block of stock of a single private investor runs the risk of an outsider taking over management.

(v) The risks involved, especially, the possibility that a financial contributor may anytime try to withdraw an investment or to extract a higher interest rate. For many businesses, the cost of obtaining funds and the timing of principal and interest payments are the dominant financial considerations.

3. Sources of Funds

(a) Equity

Equity sources of funds include ordinary shares (common), preference shares, and retained earnings.

(i) Ordinary or Common Stock

Common stock is defined as a security that represents an ownership interest in a corporation i.e. a limited liability company. The commonstock holders own and control the corporation, elect its board of directors, and receive dividends declared out of residual earnings.

Advantages and Disadvantages

A major advantage of common stock as a source of long-term funds is its lack of fixed charges. There, are no obligations for the firm to pay interest or redeem the issue at maturity date. As a result, there is much less financial risk and pressure on the firm. In addition, common stock may be sold more easily than debt.

On the other hand, the use of common stock has its own disadvantages. First, it usually has a higher cost of capital than other securities. It is also more costly to sell because of the higherflotation costs connected with the under-writing. Furthermore, liberal use of common stock can dilute the present stockholders’ control as well as the earnings per share. Another disadvantage is that common stock dividends are not deductible as expense for Income Tax calculations, but bond interest is deductible.

(ii) Preferred Stock

Preferred Stock is defined as a security that represents an ownership interest in a company with a fixed rate of return payable as dividends. It is distinguished from ordinary shares by being given preferential rights over profits, and in the event of winding up, over surplus assets, up to a specified amount. The priority claim is above that of the common stock but below all debt obligations. For example, a 9% preference share entitles the owner to receive a dividend anywhere between ‘0’ and 9%, if any ordinary dividend is to be paid.

Preferred stock may have different features that tend to make them attractive for investment. These include the following:

Cumulative or Non-Cumulative

In a case of cumulative preferred stock, dividends omitted in any year are allowed to accumulate. The arrears of dividends so accumulated are paid at any future time the company is able to declare payment of dividends. This payment is made before any common stock dividend is paid. Most preferred stock are of this type.

Non-cumulative Preferred Stocks are not paid any passed dividends. Such dividends are not allowed to accumulate as in the case of cumulative preferred stocks.

Advantages and Disadvantages

Advantages

(a) Preferred stock offers financing flexibility which avoids the rigidity of the bond’s fixedinterest obligation. In contrast to bonds, it enables a firm to conserve mortgageable assets.

(b) The use of the preferred stock does not dilute the earnings per share of the common stock.

(c) The use of preferred stock also ‘avoids the provision of equal participation in earnings that the sale of additional common stock would require.

(d) Preferred stock expands the firm’s equity base without jeopardizing control since most preferred stocks do not have voting rights.

Disadvantages

Preferred stocks do, however, have some disadvantages such as the following:

(a) Preferred stock has a higher cost of capital compared to debt capital. This is because interest payments on debt capital is tax deductible but preferred dividends are not.

(b) A growing firm which wishes to retain its earnings for reinvestment may find it difficult to do so with the use of preferred stock.